'Payrolls NDX':

***remember this is an illustration of what i am trading and my thinking...it is not a recommendation for you or anyone else to buy or sell this or any other security...trade at your own risk**

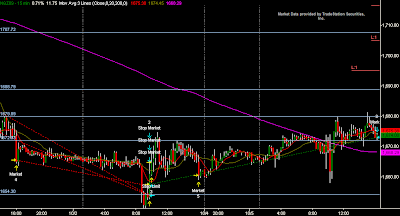

- the 'Payrolls NDX' model booked a 0.79% profit today...the trading position (NQZ09) booked a 0.72% profit (including commissions)...the last two trades on this model were stops, so it is nice to see the model 1) not stop out; 2) generate a profit....

- in terms of NQ point, this trade generated +12.50 NQ points/contract, 3 contracts traded...

- NQ showed rw compared to the ES today...SMH underperformed, while the XLF outperformed...

- early last week, i made a call that the NQ could take out its recent swing high by the end of the week...unfortunately, not only did we not take out the recent highs, but the NQ fell to new lows by friday...

- for my discretionary swing trading position in the NQZ09, i remain long 3 contracts at an average of 1685.17...

- i am currently offering 1 contract at the following levels: 1695.00, 1705.00, 1716.50...

- i am still bullish for the longer term, just riding out what i believe is a shorter term move down...

- the 'BTD Index' model remains long 1 NQZ09 at 1665.50...

- the low of this swing move down (10/2), came on the day after the first closing break of the lower bollinger band on the NDX daily chart (10/1)...this fits the previously discussed pattern of marking the last 3 swing lows before making a new swing high...

***remember this is an illustration of what i am trading and my thinking...it is not a recommendation for you or anyone else to buy or sell this or any other security...trade at your own risk**

No comments:

Post a Comment