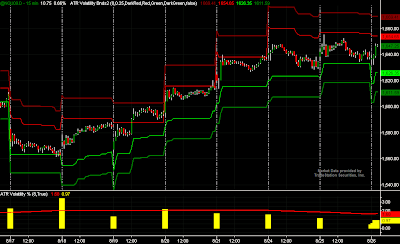

'1 CT Spyder' generated a long entry signal for tonight's close (8/31/2009).

The model was rebuilt as of today. The overall logic has remained the same. The parameter setting for the primary filter and for the dynamic stop size were tweaked just a little bit.

The model's equity curve flat lined from the beginning of 2006 through the beginning of 2008. In April of 2008 the model broke out to the upside followed by two additional trades and two additional equity curve highs.

Here are some of the model's Performance Statistics:

- Model Tracking Vehicle=SPY

- Start Date=2/2/1993

- Number of Trades=46

- Average Trade Return=0.63%

- Average Winning Trade Return=1.18%

- Average Losing Trade Return=-0.92%

- Win Rate=74%

- Ratio of Average Win/Average Loss (RAWAL)=1.29

- Profit Factor=3.65

Disclosure: Long ESU09.

Disclosure: The performance results shown above are for Model analysis purposes and do not include commission or slippage. The model is built on data from the SPY, but I trade the model with the ES e-mini. Actual trading results from the ES usually differ from the model results of the SPY, with the ES showing somewhat weaker performance data. Nonetheless, I still trade this model with the ES and when executed according to the plan, it has generated consistent profitability for me.

***remember this is an illustration of what i am trading and my thinking...my trading plan may change without notice...this is not a recommendation for you or anyone else, to buy or sell this or any other security...***